Get your Employee Retention Credit today.

Under the American Rescue Plan Act of 2021, the Federal Government has authorized up to $26,000 in refunds per employee that were on payroll in 2020 and 2021.

Chiropractor

Credit Amount: $1,876,459

Mexican Cantina

Credit Amount: $257,493

System Built to Maximize your Returns

Our system is designed to maximize your returns and automate the entire process

Risk-Free

We do not get paid unless your return significantly exceeds your investment. Customer returns average between 5x - 10x their investment

Fast & Easy Returns

Find out how much you are owed within 48 hours with little effort on your part

Join 100's of Happy Customers

Restaurants, bars, medical practices, non-profits, retailers e-commerce stores, bakeries, chiropractors, hotels, motels, and many other businesses have already claimed their Employee Retention Credit (ERC).

Over $10M+

Delivered to our customers to date.

Brewery & Pub

Credit Amount: $247,890

Fine Dining Restaurant

Credit Amount: $719,364

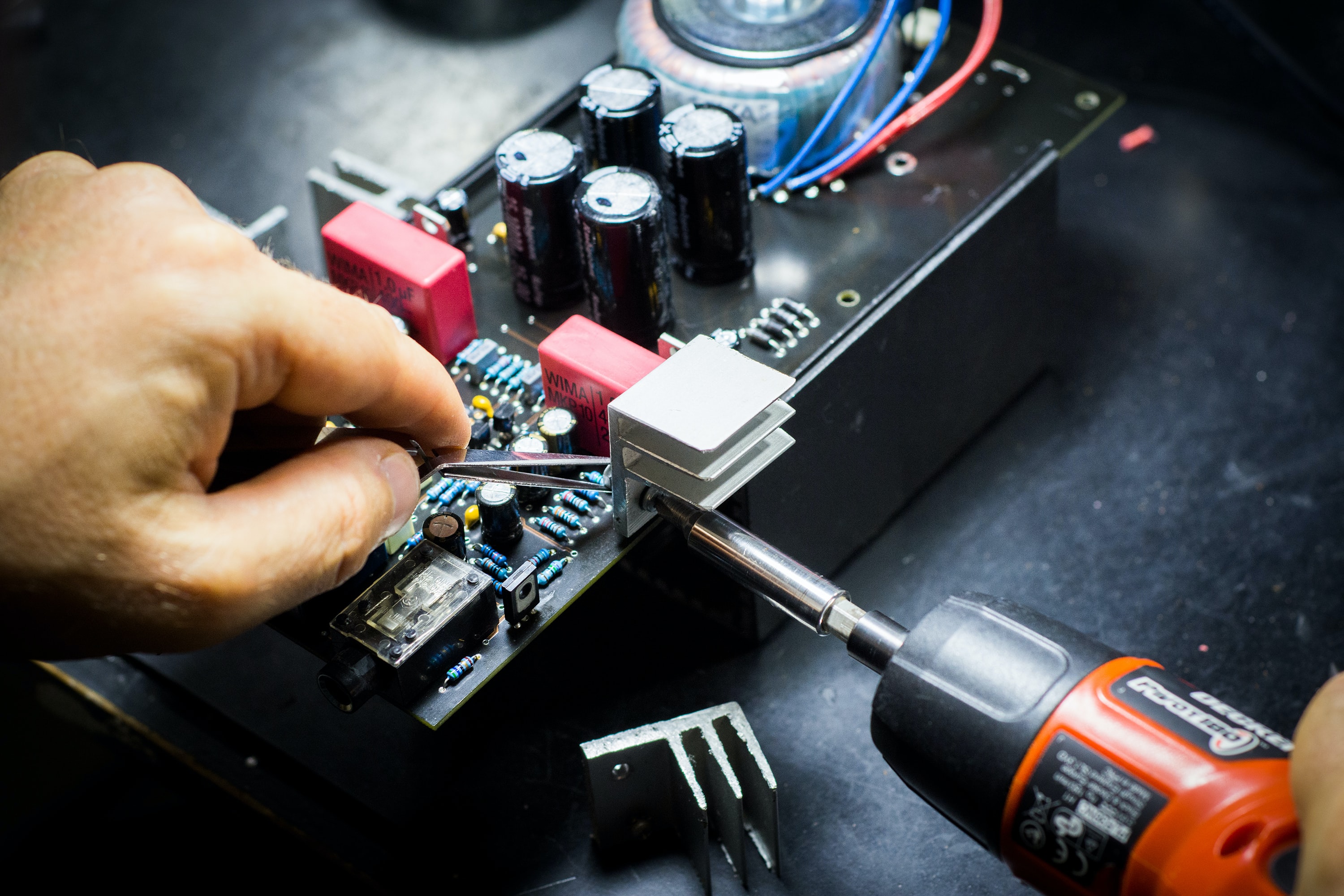

Electronics Manufacturer

Credit Amount: $1,719,654

Chiropractor with 18 locations

Credit Amount: $1,868,523

E-Commerce Retailer

Credit Amount: $190,623

Testimonials

Client Thoughts

Electronics Manufactuer

Credit: $1,788,945.00 (Ventura, CA)

Greg L.

Owner of electronics manufacturing company (90+ people)

“I was blown away!”

A finance consultant we used recommended we speak with ERT Credit about claiming the ERC. I really did not know what to expect. I setup a 30 minute online meeting (Covid restrictions) with Jordan and Kash. These guys knew exactly what they were talking about.

We engaged their services shortly after this meeting. It was an easy decision since they do not require any payment up front and we could cancel at anytime before taking delivery.

In under 48 hours they called me and asked if I wanted to take delivery of my $1.7 million dollar credit? My response hell yes! These guys are incredible!

Flooring Manufacturer

Credit: $598,189.09 (Brattleboro, VT)

George T.

Owner Wide Plank Flooring Manufacturer

“Unreal returns!”

My brother Henry used ERT Credit. He runs a startup in Ventura CA, and got to know about ERT from a friend. Henry felt we would benefit by contacting these guys.

We did not expect much but were curious so after verifying that we were eligible due to significant supply chain disruptions, we engaged ERT Credit. We were shocked to hear that we were going to get back almost $600K!

Their attention to detail and impressive customer support kept us feeling very relaxed and comfortable through the process.

Defense Manufacturer

Credit: $2,261,936.25 (Pulaski, TN)

Joe W.

Owner Defense Manufacturer

“Found these guys due to a Linkedin ad, took a chance. Wow!”

I saw an ad these guys were running on Linkedin, so I filled out their contact request form. Kash started calling and emailing me to talk. I was busy so it took me a couple days to call him back.

I own another company where we filed this credit and recieved a significant return. However, it took us a long time to get it done and things were not done quite right. I was also concerned about ERT Credit sticking around long term.

Kash and Jordan ran an incredibly tight process that moved our company through the eligibility and computations for this credit in a matter of hours. What an awesome experience. Zero load on my internal accounting staff. They got things done in a matter of days so we could close our books. These guys exemplify amazing customer service and scale.

ERT CREDIT

How Does it Work?

Data Gathering

Use our secure webform to upload your PPP loan documents, share payroll data, and answer preliminary questions.

Credit Calculation

Our system calculates the exact credit amount you will receive from the IRS. Our experts then review every detail to make sure everything is filed perfectly with the IRS.

Amending Returns

We will prepare and audit all documentation and help you file the necessary amended payroll tax returns.

Get Paid

The IRS will process the credit and mail you a check(s).

Why ERT.Credit?

Your entire commitment will be less than 15 minutes.

Audit-proof supporting documentation for IRS support.

Guaranteed to maximize your credit and leave no money on the table.

This is what we do daily for scores of businesses across the country.

RESULTS

Client Results

Irish Pub & Tap Room

Credit: $659,015.63 (Royal Oak, Michigan)

Keith S.

Owner at Irish Pub & Tap Room

“It took a while for the IRS to send out refund checks, but the money certainly arrived!”

I have known Jordan (CEO ERT.Credit) for a while. When Jordan first told me about the credit, I was skeptical. Jordan explained that this is a government incentive because we kept a lot of people on payroll during the pandemic. Those folks did not claim unemployment which was a net positive for the government and the taxpayer. Jordan warned us the wait was long and getting longer, so we moved quickly to secure the money owed to us.

Jordan is a clear professional and throughout the entire process, we were never left in the dark. He maximized our credit when our CPA turned us away. This was an eye opener.

Seafood Restaurant & Bar

Credit: $300,637.63 (Birmingham, MI)

Beth H.

Owner at Seafood Restaurant & Bar

“I was ERT.Credit's second customer.”

Like a lot of ERT.Credit's first few customers, I knew Jordan (CEO ERT.Credit) well. He ate at our restaurant often and we became friends. So, when Jordan first told us about the credit, all we had to go on was our relationship. Jordan did not take this lightly. He spent all the time necessary to help us get comfortable and understand this credit. He was not satisfied until I was, and he let me know that from the beginning. From pulling payroll records to the amended financial reports, he handled everything from start to finish.

Thank you, Jordan, and ERT.Credit. The money showed up and with interest! What a pleasant surprise.

Pizza Chain Franchise

Credit: $1,721,269.58 (7+ Stores Detroit, MI)

John S. (Owner)

Owner of Pizza Chain Franchise

“My accountant was not a reliable source for information about this credit.”

I attended a webinar about the credit put on by the National Restaurant Association. My accountant knew nothing about it. I called Jordan and it was clear he was well-versed on the credit and was able to quickly lay out the process to claim the credit. Jordan had already done this credit a few times for several other customers I was aware of. He wrapped things up rather quickly for me. I have sent all my fellow restaurant friends to ERT.Credit. My friends were deeply appreciative of the service they received.

It is still early. If you want to get this filed for maximum benefit and do it fast, just use ERT.Credit.

Frequently Asked Questions

FAQ

What is the ERC?

The Employee Retention Credit is a payroll tax credit that almost every business qualifies for under the CARES Act. It was designed to help small and medium-sized businesses retain their employees during these difficult times. The credit is simply refunding payroll costs already spent and any surplus that may be available.